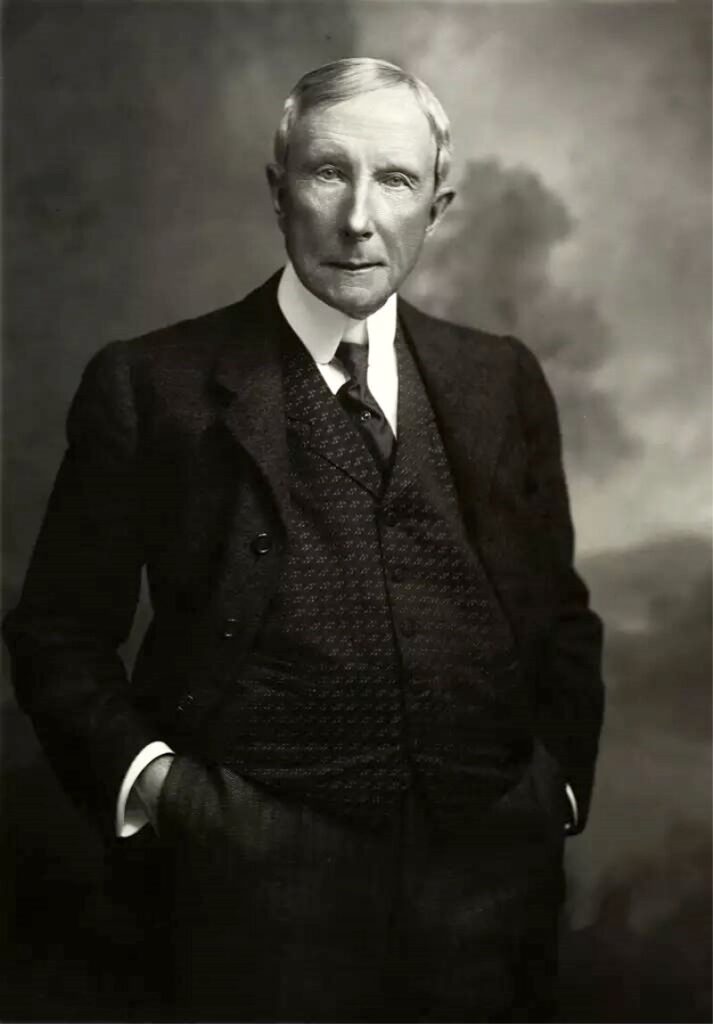

John D. Rockefeller is still a name synonymous with vast wealth and unparalleled influence. To this day he remains an icon of American business history.

His life story is a testament to the remarkable heights one can reach through tough business strategies and unwavering determination.

In this article, we delve into the life and business of John D. Rockefeller, shedding light on how he would become one of the wealthiest individuals in history.

Early Life and Entrepreneurial Beginnings

John Davison Rockefeller was born on July 8, 1839, in Richford, New York on the cusp of the Second Industrial Revolution.

It was an era marked by significant technological advancements, including the development of the telegraph, the expansion and standardization of the railway system, and the growth of the steel industry.

Raised in a modest household, the young Rockefeller learned early on the values of discipline, and hard work. These values would later translate into savvy business acumen.

His father, a traveling salesman, instilled in him the value of a dollar. His mother, a thrifty woman, taught him the principles of frugality that would shape the way he ran his business empire.

Early Exposure to Business and Entrepreneurship

Rockefeller had a natural talent for numbers, even at an early age. His entrepreneurial spirit shined at an early age when he got his first taste of business as a candy broker for his friends.

Later he would lend small amounts of money to his friends. This gave him an early lesson in the art of financial management and risk assessment.

First Steps in the Oil Industry

In the mid-19th century, whale oil was falling out of fashion.

The discovery of abundant sources of oil and the development of the kerosene refining process offered a more cost-effective and efficient alternative for lighting. Kerosene lamps provided a brighter and more consistent light than whale oil lamps.

Young Rockefeller predicted that the United States was on the verge of an oil revolution. So he took a chance and invested in the Cleveland oil refining business with Samuel Andrews and the Clark brothers, Benjamin and Daniel, in 1865.

Rockefeller was a shrewd businessman and saw the potential for consolidation in the oil industry. He recognized that controlling the entire process, from oil production to refining and distribution, would lead to greater efficiency and profitability.

As Rockefeller continued to grow the company, he negotiated deals and restructured the business. This ultimately led to the buyout of the Clark brothers and Samuel Andrews.

In 1866, John Rockefeller’s brother, William Rockefeller Jr., took the initiative to construct a new refinery in Cleveland and brought on John as a partner. The following year, Henry Morrison Flagler also became a partner. And the company known as Rockefeller, Andrews & Flagler was born.

Standard Oil: The Empire that Built Rockefeller’s Wealth

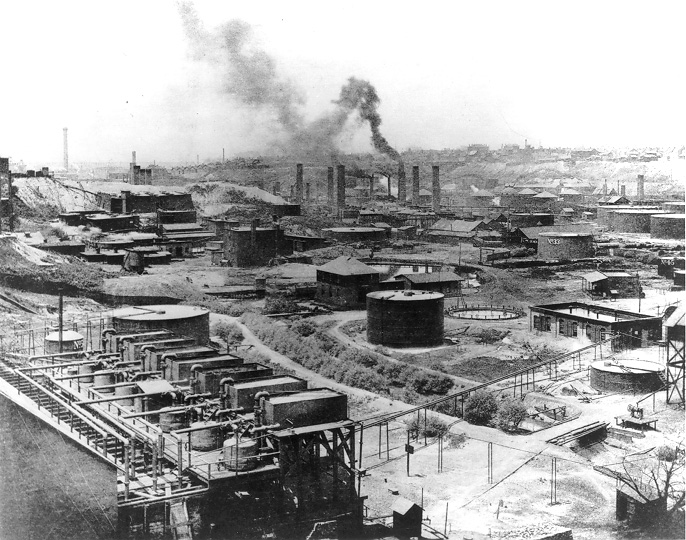

On January 10, 1870, John D. Rockefeller dissolved the partnership of Rockefeller, Andrews & Flagler. In its place, he established Standard Oil of Ohio.

Rockefeller wasted no time in expanding the company’s operations. The company rapidly grew and became Ohio’s most profitable oil refiner.

In order to secure his dominance, Rockefeller would buy up smaller more vulnerable competitors and vertically integrate his business using the following tactics:

Identifying Competitors: Rockefeller had an extensive network of agents and spies gathering information about other refineries.

Offering Competitive Buyouts: When Rockefeller targeted a competitor, he would often make them an offer they couldn’t refuse. He showed them his books to reveal the efficiency and cost advantages Standard Oil had, making it clear that competing independently was almost impossible.

Bankruptcy and Auctions: If a competitor refused Rockefeller’s offer, he followed through on his threat. He would use Standard Oil’s financial might to undercut the competitor’s prices until they went out of business. Then, Rockefeller would buy their assets at auction at a fraction of their actual value.

Horizontal Integration: Rockefeller expanded horizontally by acquiring competitors within the same industry, which allowed Standard Oil to control more significant portions of regional and national markets. In Cleveland alone, Standard Oil absorbed 22 of 26 competitors.

Vertical Integration: Rockefeller took control of every aspect of the oil production and distribution process, greatly reducing costs while boosting profits. This included owning pipelines, tank cars, and even building his own barrel-making facilities to save on the cost of oil storage and transportation.

Market Manipulation: To maintain control over the oil market, Standard Oil would sometimes sell its products below cost to drive competitors out of business. Once the threat was out of business, they could raise prices and recoup their losses.

Railroad Rebates and the Rockefeller Advantage

Railroads played a vital role in the American economy after the Civil War.

During this time markets were booming and industries relied on railroad companies to ship their products around the country. One of the key strategies employed by John D. Rockefeller and Standard Oil in their quest for market dominance was the negotiation of favorable railroad rebates.

Securing these rebates allowed Standard Oil to dramatically reduce transportation costs. The discounts and preferential treatment ensured that Standard Oil could move its products more efficiently and cost-effectively than its competitors.

This gave the company a substantial competitive advantage, as it could undercut the prices of smaller, independent oil companies. These rebates also had the bonus of discouraging railroads from working with Standard Oil’s competitors, limiting their access to transportation networks.

Diversification and Wealth Accumulation

As John D. Rockefeller’s wealth continued to grow, he knew that he shouldn’t keep all his eggs in one basket. He diversified his financial interests across various sectors, including finance, transportation, and manufacturing.

Some of his investments included banks, railways, and even companies like U.S. Steel. These strategic investments compounded his wealth and helped secure his status as one of the wealthiest individuals in history.

By 1913 Rockefeller had become the country’s first billionaire, with a net worth of nearly 2% of the U.S. economy.

Standard Oil’s Monopoly: The Rise and Fall

By the late 19th century John D. Rockefeller’s Standard Oil had achieved a near-monopoly in the oil industry. Through aggressive acquisitions, vertical integration, favorable railroad rebates, and ruthless business strategies, Standard Oil controlled a whopping 90% of the oil refining in the United States.

This dominance allowed the company to not only set oil prices but also control distribution, and dictate terms to competitors.

Legal Challenges and Antitrust Actions

Standard Oil’s unchecked power and monopolistic practices began to raise concerns and criticisms from other businesses. This increased the public and political pressure to address the company’s stranglehold on the oil industry.

This led to an expose by investigative journalist, Ida Tarbell, who exposed Standard Oil’s business practices for the country to see. Public sentiment began to shift against the company, prompting federal and state authorities to take action.

The Breakup of Standard Oil

With growing concern over the monopoly of Standard Oil, the U.S. The Supreme Court took the matter up in 1911. In the landmark case of Standard Oil Co. of New Jersey v. The United States, the court ruled that Standard Oil’s aggressive practices and vertical integration had violated the Sherman Antitrust Act.

As a result, the court ordered the breakup of Standard Oil and its assets divided up into smaller, independent companies. These companies were each responsible for different aspects of the oil industry, including production, refining, and distribution.

These newly formed entities included corporations like Exxon, Mobil, and Chevron, which still exist today.

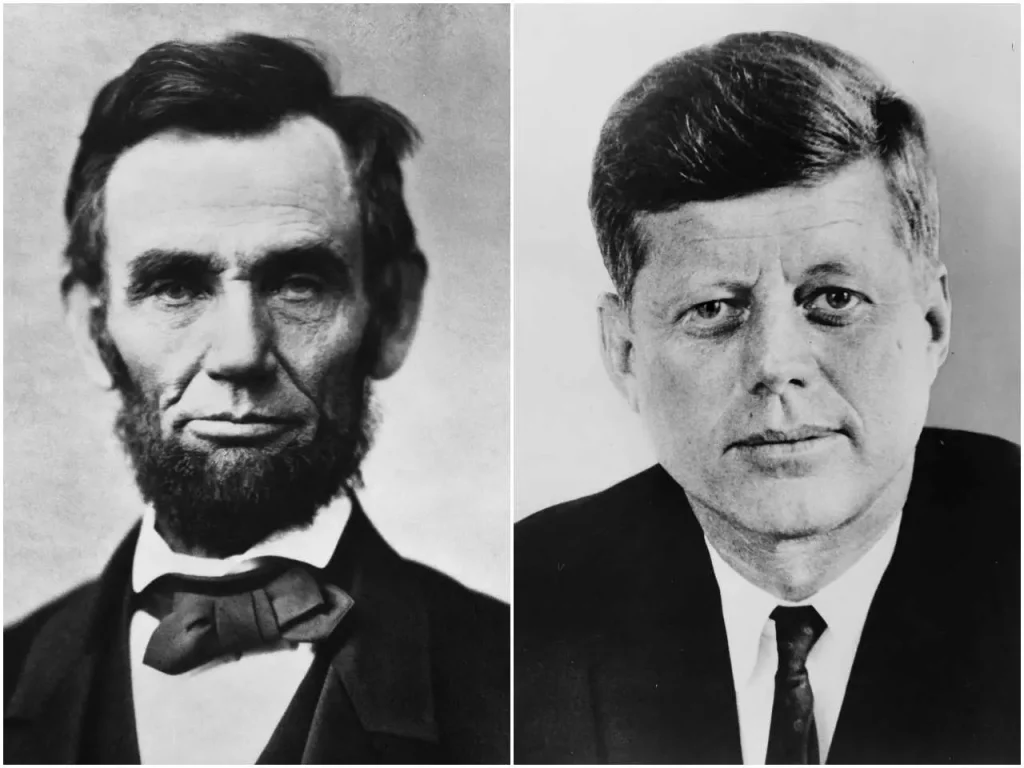

Shaping Modern Business and Antitrust Laws

The business practices of Rockefeller and Standard Oil played a pivotal role in the shaping of modern business and antitrust laws in the United States. The aggressive and monopolistic strategies employed by Standard Oil opened the public’s eyes to the abuse of corporate power.

These concerns ultimately led to the development of stronger antitrust regulations aimed at preventing monopolies and promoting fair competition. The breakup of Standard Oil set an example to other large corporations. It also sent a powerful message to other tycoons who may have had similar ideas.

The same laws would be used again in 1948 when the U.S. government was forced to take action against the monopoly of Paramount Pictures.

Philanthropy and the Rockefeller Legacy

John D. Rockefeller’s legacy extends far beyond the oil industry as his significant wealth enabled him to become one of the most prominent philanthropists in American history. His philanthropic efforts through the Rockefeller Foundation have made substantial contributions to global health, education, and scientific research.

Rockefeller’s business practices, which included vertical integration and cost-efficiency strategies, played a pivotal role in shaping modern business and antitrust laws. And his approach to corporate efficiency remains influential today.

The Rockefeller family‘s dedication to philanthropy and societal betterment endures across generations. This is seen in their ongoing commitment to charitable initiatives spanning various causes and inspiring future philanthropists worldwide.

References

Biography: John D. Rockefeller, Senior

https://www.pbs.org/wgbh/americanexperience/features/rockefellers-john/

John D. Rockefeller

https://en.wikipedia.org/wiki/John_D._Rockefeller

Sherman Anti-Trust Act (1890)

https://www.archives.gov/milestone-documents/sherman-anti-trust-act